Table of Contents

- Executive Summary: Key Findings and 2025 Outlook

- Market Size and Forecast Through 2030

- Cutting-Edge Technologies in Cryogenic Leak Detection

- Major Industry Players and Recent Strategic Moves

- Application Trends: Healthcare, Energy, and Food Logistics

- Regulatory Landscape and Compliance Requirements

- Regional Analysis: North America, Europe, Asia-Pacific, and Beyond

- Challenges: Technical Barriers and Safety Concerns

- Innovation Pipeline: Upcoming Products and R&D Highlights

- Future Outlook: Disruptive Trends and Strategic Recommendations

- Sources & References

Executive Summary: Key Findings and 2025 Outlook

Cryogenic refrigerant leak detection systems are experiencing heightened demand and technological evolution as industries prioritize safety, operational reliability, and compliance with stricter environmental regulations. These systems, essential in sectors such as healthcare, food processing, liquefied natural gas (LNG), and industrial gas production, are critical for early detection of leaks involving refrigerants such as liquid nitrogen, carbon dioxide, and liquefied natural gas—substances that present both safety hazards and environmental risks.

In 2025, regulatory momentum continues to shape the market. The American Society of Heating, Refrigerating and Air-Conditioning Engineers (ASHRAE) and the U.S. Environmental Protection Agency (EPA) are actively updating standards for refrigerant handling and leak detection, including requirements for continuous monitoring and automated alarm systems in occupied spaces and process environments. The revised ASHRAE Standard 15 and EPA Section 608 rules are pushing facilities toward rapid adoption of smarter, more sensitive detection solutions.

Commercial and industrial facilities are increasingly adopting advanced sensing technologies. Market leaders such as Honeywell and Emerson Electric Co. have launched new fixed gas detection platforms integrating infrared, ultrasonic, and electrochemical sensors. These allow for real-time monitoring, remote diagnostics, and integration with building automation systems, reducing both false alarms and response times. For example, Honeywell’s Searchzone Sonik and Searchline Excel Edge solutions provide robust detection of cryogenic gas leaks in harsh environments, supporting compliance with international safety protocols.

In the industrial gases sector, companies like Air Liquide are investing in digitalization strategies, equipping storage and distribution infrastructure with IoT-enabled sensors for continuous leak monitoring. Data analytics platforms are being deployed to predict maintenance needs and optimize response to detected leaks, further reducing environmental impact and operational downtime.

Looking ahead to the remainder of 2025 and the next few years, the outlook for cryogenic refrigerant leak detection systems is robust. Industry adoption is expected to accelerate as facilities upgrade to comply with new standards and as insurance providers and government agencies increasingly mandate best-in-class detection technologies. Ongoing innovation—such as miniaturized wireless sensors, AI-driven anomaly detection, and cloud-based monitoring—will continue to improve the sensitivity and reliability of leak detection systems, supporting safer operations and stronger environmental stewardship across sectors.

Market Size and Forecast Through 2030

The global market for cryogenic refrigerant leak detection systems is poised for steady growth through 2030, driven by expanding applications in healthcare, energy, food processing, and the semiconductor industry. In 2025, market demand is being shaped by stricter environmental regulations, heightened safety standards, and the increasing deployment of liquefied gases such as LNG, liquid nitrogen, and liquid oxygen across industrial sectors. This has prompted facility operators to invest in advanced leak detection technologies to ensure compliance and operational integrity.

Recent data from leading system manufacturers indicate a sustained increase in installations. For instance, MSA Safety Incorporated and Drägerwerk AG & Co. KGaA have reported expanding demand for their fixed and portable gas detection solutions tailored to cryogenic environments. These systems employ technologies such as infrared sensors, ultrasonic detectors, and electrochemical sensors to provide early warning of refrigerant leaks, reducing the risk of hazardous exposures and costly product losses.

In 2025, North America and Europe remain the largest markets, fueled by stringent occupational safety and environmental regulations, such as the European F-Gas Regulation and U.S. OSHA standards. However, the Asia-Pacific region is expected to exhibit the fastest growth rate, supported by rapid industrialization, infrastructure expansion, and growing investments in LNG and cold storage facilities. Companies like Honeywell International Inc. and Gas Detectors USA are actively expanding their product portfolios and regional footprints to address burgeoning demand in these markets.

Looking ahead, the outlook for 2026-2030 anticipates increasing adoption of digitalized and connected leak detection systems. The integration of IoT capabilities, real-time data analytics, and remote monitoring is expected to become standard, enabling predictive maintenance and faster incident response. Leading suppliers, including SevenGen and Gas Alarm Systems, are investing in R&D to develop next-generation detectors with enhanced sensitivity, lower false alarm rates, and compatibility with a broader range of refrigerants.

Overall, the cryogenic refrigerant leak detection systems market is forecasted to maintain a robust compound annual growth rate (CAGR) through 2030. Key growth drivers include regulatory pressures, the proliferation of cryogenic facilities, and advances in detection technology, positioning the sector for significant expansion in the coming years.

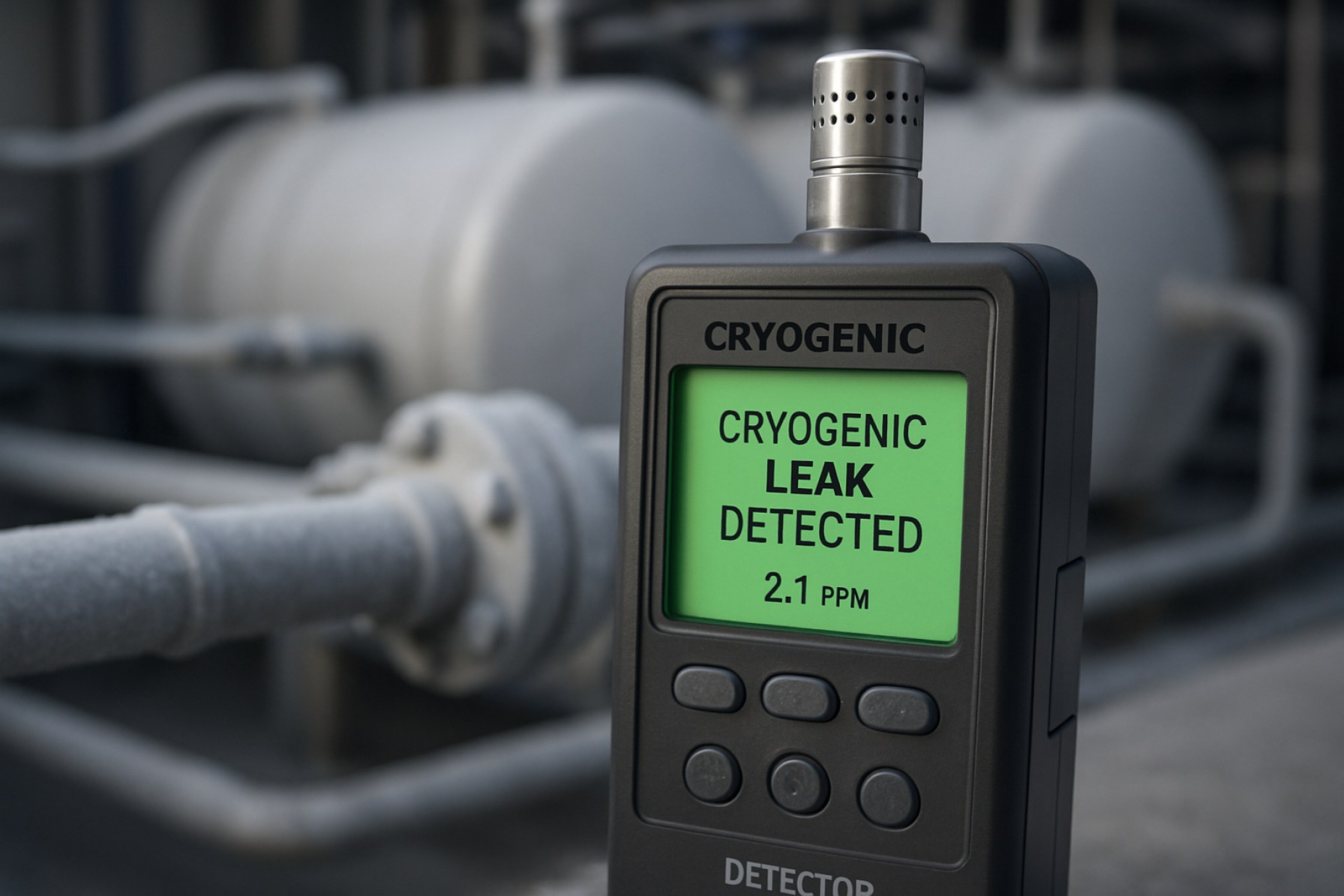

Cutting-Edge Technologies in Cryogenic Leak Detection

Cryogenic refrigerant leak detection systems are rapidly advancing, driven by the necessity for improved safety, regulatory compliance, and efficiency in sectors such as liquefied natural gas (LNG), medical gas storage, and high-performance computing. As of 2025, leading-edge technologies are transforming how leaks of cryogenic refrigerants—including liquid nitrogen, helium, and hydrogen—are detected, with a focus on real-time monitoring, increased sensitivity, and integration with plant automation.

One significant development is the adoption of laser-based gas detection technologies. Tunable diode laser absorption spectroscopy (TDLAS) enables the remote and rapid identification of trace amounts of refrigerant gases even in challenging environments. This technology is being implemented in industrial settings for its ability to provide continuous, non-contact monitoring with very low detection limits, often in the parts-per-million range. Companies such as SICK AG and Siemens AG are actively advancing laser-based detection platforms that are robust enough for cryogenic environments.

In parallel, wireless and IoT-enabled leak detection systems are becoming mainstream. These systems leverage distributed sensor networks that communicate data in real time to centralized control rooms, providing early warning and automated shut-off capabilities. For instance, Emerson Electric Co. offers wireless leak detection solutions suitable for extreme temperature applications, including those involving cryogenic refrigerants. This trend is expected to accelerate, with increased adoption across large-scale facilities handling cryogenic gases.

Electrochemical and solid-state sensors are also seeing improvements in selectivity and durability. Manufacturers like Honeywell International Inc. have developed sensors specifically rated for ultra-low temperature operation, which maintain stable performance and long calibration intervals even when exposed to harsh cryogenic conditions.

Looking ahead to the next few years, integration with advanced data analytics and predictive maintenance platforms is anticipated to further enhance leak detection. By combining real-time sensor data with machine learning algorithms, operators can predict potential leak points before they occur and optimize maintenance schedules, reducing downtime and operational risk. Additionally, evolving safety standards, such as those from the ASHRAE, are expected to drive further innovation and adoption of advanced detection systems.

As these technologies mature, the outlook for cryogenic refrigerant leak detection is robust, with ongoing investments in sensor accuracy, connectivity, and automation poised to redefine industry best practices through 2025 and beyond.

Major Industry Players and Recent Strategic Moves

The landscape of cryogenic refrigerant leak detection systems is being shaped by several major industry players, each advancing their product offerings and strategic collaborations to address the evolving needs of sectors such as healthcare, food processing, energy, and scientific research. In 2025, companies are responding to stricter safety regulations, the global expansion of cryogenic technologies, and increased demand for high-sensitivity, real-time leak detection in critical environments.

Prominent among these players is Honeywell, which continues to innovate in fixed and portable gas detection solutions designed for cryogenic storage and transport. In early 2025, Honeywell announced enhancements to its Sensepoint XRL series, integrating advanced wireless connectivity and improved sensor calibration for faster detection of cryogens like liquid nitrogen and helium, aiming to reduce response times and enhance worker safety in industrial and laboratory settings.

Another key participant, MSA Safety Incorporated, expanded its Ultima X5000 range in late 2024 with multi-gas detection modules optimized for very low-temperature and high-humidity applications. MSA’s investment in digital, cloud-connected monitoring platforms has enabled predictive maintenance and remote diagnostics, features increasingly sought by pharmaceutical and biotech clients handling cryogenic materials.

On the sensor manufacturing front, AMETEK has continued its partnership with industrial gas suppliers, integrating its high-precision gas analyzers into large-scale cryogenic facilities. In 2025, AMETEK introduced an updated analyzer with laser-based detection, significantly increasing sensitivity for early-stage refrigerant leaks and meeting the more stringent emissions and safety standards coming into force in Europe and North America.

Strategic collaborations have also marked recent developments. Dräger partnered with a major European cryogenic logistics company in 2025 to pilot AI-driven leak detection networks across distribution hubs, employing machine learning algorithms to reduce false alarms and optimize maintenance cycles. This collaboration is anticipated to set new benchmarks for automated cryogenic safety management.

Looking ahead, these companies are expected to focus on integrating IoT connectivity, AI analytics, and compliance with evolving international safety codes, as the global market for cryogenic refrigerant leak detection is projected to expand through the decade. The ongoing strategic moves—product innovation, digital transformation, and cross-sector partnerships—underscore the sector’s commitment to safety and operational efficiency amid rapid technological and regulatory change.

Application Trends: Healthcare, Energy, and Food Logistics

The adoption of cryogenic refrigerant leak detection systems is accelerating in critical sectors such as healthcare, energy, and food logistics, driven by tightening safety regulations and the increasing reliance on cryogenic gases. In 2025 and beyond, these industries are expected to see significant advancements in both the deployment and sophistication of leak detection technologies.

In healthcare, the use of cryogenic liquids like liquid nitrogen for the storage and transport of biological samples and vaccines necessitates reliable leak detection to ensure safety and product integrity. Recent investments in automated monitoring platforms, such as the Thermo Fisher Scientific CryoSmart system, demonstrate the sector’s move toward continuous, real-time cryogen monitoring. Hospitals and biobanks are increasingly deploying networked sensors to immediately alert staff in the event of cryogen leaks, minimizing risks to personnel and critical inventory.

The energy sector, particularly in the liquefied natural gas (LNG) industry, relies heavily on cryogenic leak detection to prevent hazardous incidents and comply with evolving regulations. Companies like Honeywell have introduced advanced gas detection solutions tailored for LNG plants, featuring multi-point detection and wireless connectivity. As global LNG capacity expands in 2025 and new facilities come online, the demand for integrated leak detection—combining infrared, ultrasonic, and chemical sensing technologies—is projected to rise sharply. This is corroborated by recent deployment announcements from Emerson, which has outfitted LNG terminals with their Rosemount gas detection systems to monitor for cryogenic refrigerant leaks in real time.

Food logistics is another sector undergoing rapid transformation due to the growing need for secure cold chain management. Cryogenic refrigerants such as carbon dioxide and liquid nitrogen are widely used in frozen food transportation and storage. To prevent spoilage and ensure safety, companies like MSA Safety and Dräger are partnering with logistics providers to deliver wireless, cloud-connected gas leak detectors. These systems are increasingly being integrated with fleet management platforms, enabling predictive maintenance and automatic incident reporting across geographically dispersed cold storage units and transport solutions.

Looking ahead, the convergence of IoT, machine learning, and cloud analytics is expected to further enhance the responsiveness and predictive capabilities of cryogenic refrigerant leak detection systems. This trend will likely lead to deeper integration of detection systems into facility management and supply chain software, ensuring regulatory compliance and operational efficiency across healthcare, energy, and food logistics through 2025 and beyond.

Regulatory Landscape and Compliance Requirements

The regulatory landscape for cryogenic refrigerant leak detection systems is rapidly evolving as global efforts to mitigate greenhouse gas emissions intensify. In 2025 and the coming years, regulatory requirements are increasingly focused on the safety, environmental impact, and efficiency of refrigeration systems utilizing cryogenic refrigerants such as liquid nitrogen, liquid hydrogen, and liquefied natural gas (LNG).

In the United States, the Environmental Protection Agency (EPA) continues to enforce the Clean Air Act Section 608, requiring operators of refrigeration equipment to implement effective leak detection and repair protocols. Notably, the EPA’s Significant New Alternatives Policy (SNAP) program is pushing for the transition to refrigerants with lower global warming potential (GWP), intensifying scrutiny on leak minimization and detection technologies U.S. Environmental Protection Agency (EPA). For facilities handling cryogenic refrigerants, compliance with Occupational Safety and Health Administration (OSHA) standards, particularly 29 CFR 1910.101 for compressed gases and 1910.119 for process safety management of highly hazardous chemicals, mandates robust detection and notification systems to prevent accidental releases Occupational Safety and Health Administration (OSHA).

In Europe, the F-Gas Regulation (EU) No 517/2014 and its amendments are central to compliance. The regulation requires operators to install permanent leak detection systems for refrigeration units containing more than 500 tonnes of CO2 equivalent in gases, with mandatory annual or more frequent checks depending on refrigerant volume European Commission. The upcoming revision, scheduled for implementation in 2025, is expected to further tighten leak detection obligations and accelerate the adoption of automated, continuous monitoring systems.

Internationally, the International Institute of Refrigeration (IIR) and the International Organization for Standardization (ISO) are updating guidelines and standards, such as ISO 5149 for refrigerating systems and safety and environmental requirements, to reflect evolving best practices in leak detection for cryogenic applications International Organization for Standardization (ISO). These updates emphasize early detection, rapid notification, and data logging for compliance verification.

Industry response has been robust, with manufacturers such as MSA Safety Incorporated and Honeywell developing advanced gas detection solutions specifically tailored for cryogenic refrigerants. These systems increasingly feature real-time monitoring, wireless connectivity, and integration with facility management software to simplify compliance reporting and audits.

Looking ahead, regulatory trends point toward stricter leak detection standards, greater automation in monitoring, and expanded reporting requirements. Operators will need to invest in state-of-the-art detection systems to remain compliant, reduce environmental risk, and align with global sustainability targets in the refrigeration sector.

Regional Analysis: North America, Europe, Asia-Pacific, and Beyond

The regional landscape for cryogenic refrigerant leak detection systems is evolving rapidly in 2025, as sectors such as healthcare, energy, and industrial gases expand their reliance on cryogenic storage and transport. Advances in sensor technologies and regulatory imperatives are shaping demand and adoption across North America, Europe, Asia-Pacific, and other emerging regions.

- North America: The United States and Canada continue to lead in cryogenic infrastructure, particularly in the healthcare and liquefied natural gas (LNG) sectors. Stringent safety regulations from agencies like the U.S. Occupational Safety and Health Administration (OSHA) and the Compressed Gas Association are driving widespread implementation of advanced leak detection solutions. Companies such as Honeywell and MSA Safety Incorporated are expanding their product lines to include multi-gas detectors and wireless monitoring systems tailored for cryogenic environments.

- Europe: The European market is experiencing robust growth, propelled by investments in green hydrogen and LNG infrastructure, especially in Germany, the Netherlands, and Norway. The European Industrial Gases Association (EIGA) and harmonized EN standards are influencing the adoption of high-sensitivity leak detection. Manufacturers like Drägerwerk AG are focusing on digital integration and connectivity, enabling real-time alarm notifications and compliance with EU safety directives.

- Asia-Pacific: Rapid industrialization and healthcare expansion in China, India, and Southeast Asia are fueling significant investments in cryogenic storage and distribution. Japanese and South Korean firms, such as Tanaka Engineering, are innovating compact, high-accuracy leak detectors for both fixed installations and portable use. In China, the focus is on scalable, cost-effective solutions to meet the burgeoning demand for industrial gases and medical oxygen, with local companies ramping up domestic production of sensor technologies.

- Rest of World: In Latin America and the Middle East, LNG export facilities and industrial gas plants are adopting leak detection systems to support operational safety and environmental compliance. Companies like Gas Detector Solutions (GDS) are partnering with regional distributors to provide customized sensor arrays adapted for extreme operational environments.

Looking ahead, regulatory tightening, digital transformation, and the proliferation of cryogenic applications are expected to drive further regional growth and product innovation through 2026 and beyond.

Challenges: Technical Barriers and Safety Concerns

The deployment of cryogenic refrigerant leak detection systems is facing a unique set of technical and safety-related challenges as the industry moves into 2025 and beyond. Cryogenic refrigerants, such as liquid nitrogen, helium, argon, and liquefied natural gas (LNG), operate at extremely low temperatures and often at high pressures, which complicates both the detection and containment of leaks.

One of the foremost technical barriers is sensor reliability in cryogenic environments. Most conventional sensors experience performance degradation or outright failure at temperatures below -150°C. This has driven manufacturers to invest in specialized sensor technologies that can function in subzero conditions without loss of sensitivity or excessive false alarms. For instance, Honeywell has developed gas detection solutions with enhanced temperature tolerance, though ensuring long-term stability and minimal maintenance remains a challenge.

Another critical issue is the rapid dispersion of cryogenic gases upon leakage, making early detection vital to prevent safety incidents such as asphyxiation, fire, or explosion. Traditional point sensors may not provide sufficient coverage, prompting the adoption of open-path and distributed fiber-optic sensing technologies. However, integrating these systems into existing facility infrastructures can be complex and costly. Companies like MSA Safety Incorporated are working to address these challenges by offering scalable detection networks and real-time monitoring solutions.

Safety concerns are also intensified by the invisible and odorless nature of many cryogenic gases. Leaks may go undetected until concentrations reach dangerous levels, particularly in confined or poorly ventilated spaces. The International Institute of Ammonia Refrigeration (IIAR) has underscored the importance of rigorous leak detection protocols and continuous monitoring, especially as the use of cryogenic refrigerants expands in sectors such as healthcare, food processing, and energy.

Compliance with evolving regulations adds another layer of complexity. In 2025, stricter standards are being enforced regarding refrigerant leak detection and reporting, especially in the context of environmental impact and occupational safety. Manufacturers must ensure that their systems are not only technically robust but also capable of integrating with facility-wide safety and alarm platforms. Companies such as Drägerwerk AG & Co. KGaA are actively developing solutions that facilitate regulatory compliance while minimizing operational disruption.

Looking forward, overcoming these technical and safety barriers will require continued innovation in sensor materials, system architecture, and data integration. Collaboration between equipment suppliers and end-users, along with proactive engagement with industry bodies, will be essential to ensure that cryogenic refrigerant leak detection systems meet the demanding requirements of modern industrial applications.

Innovation Pipeline: Upcoming Products and R&D Highlights

The innovation pipeline for cryogenic refrigerant leak detection systems is accelerating as the industry responds to stricter safety regulations, higher performance demands, and the growing use of advanced low-GWP refrigerants in sectors such as LNG, industrial gases, and superconducting technologies. Looking ahead to 2025 and the following years, several major manufacturers and technology providers are unveiling next-generation products and research initiatives aimed at improving sensitivity, response time, connectivity, and integration with facility management systems.

- Enhanced Sensitivity and Selectivity: Companies like Honeywell and Siemens are advancing their fixed leak detection platforms with improved infrared (NDIR) and semiconductor sensor arrays. These developments are focused on reliably detecting minute leaks of cryogenic refrigerants such as nitrogen, helium, and hydrogen, even at extremely low temperatures, while minimizing cross-sensitivity to other gases common in industrial environments.

- IoT and Cloud-Enabled Detection: The integration of IoT connectivity is a central R&D theme. Emerson is piloting leak detection instruments capable of real-time remote monitoring, predictive diagnostics, and automatic notification to facility operators via secure cloud platforms. This trend is expected to become mainstream by 2025, facilitating faster incident response and more efficient maintenance scheduling.

- Artificial Intelligence and Data Analytics: Leveraging AI and machine learning, manufacturers are developing systems that can analyze complex sensor data, distinguish true refrigerant leaks from false positives, and even forecast potential failure points. Danfoss is actively researching AI-driven algorithms to enhance the accuracy of their cryogenic leak detectors, with pilot deployments planned in large cold storage and pharmaceutical facilities in 2025.

- Miniaturization and Integration: For applications in compact and mobile cryogenic systems, such as medical and laboratory freezers, R&D initiatives are focusing on miniaturized sensors and wireless integration. MSA Safety Incorporated is exploring MEMS-based sensor platforms that enable discreet installation and facilitate integration with building automation systems.

Looking forward, industry collaboration with academic and standards organizations is expected to further drive innovation, especially in the context of harmonized international safety standards and the adoption of more environmentally benign refrigerants. The pipeline of advanced cryogenic refrigerant leak detection solutions being readied for 2025 and beyond underscores the sector’s commitment to safety, operational efficiency, and environmental stewardship.

Future Outlook: Disruptive Trends and Strategic Recommendations

The outlook for cryogenic refrigerant leak detection systems in 2025 and the following years is shaped by rapid advancements in sensor technologies, stricter regulatory frameworks, and the increasing deployment of cryogenic refrigeration across sectors such as healthcare, energy, and food logistics. Global demand for liquid hydrogen and liquefied natural gas (LNG) infrastructure is accelerating, alongside the expansion of cold-chain logistics for pharmaceuticals and biologics, all of which heighten the need for robust, real-time leak detection capabilities.

A disruptive trend is the integration of smart, connected sensors based on infrared (IR), ultrasonic, and electrochemical technologies. Major manufacturers such as Honeywell and MSA Safety Incorporated are advancing multi-gas detectors capable of identifying trace levels of cryogenic refrigerants, such as liquid nitrogen (LN2), carbon dioxide (CO₂), and hydrogen (H₂), with greater accuracy and faster response times. These systems are increasingly being linked to centralized monitoring platforms, enabling remote diagnostics and predictive maintenance—an approach now standard in new installations by companies like Siemens.

Regulatory pressure is another key driver. Updated guidance from recognized bodies such as the U.S. Occupational Safety and Health Administration (OSHA) and the European Industrial Gases Association (EIGA) is pushing end users toward adoption of continuous, automated leak detection to mitigate safety hazards and environmental risks. In 2024, regulatory updates in the European Union around F-gas emissions and occupational exposure limits are already influencing procurement policies for cryogenic refrigeration systems, with similar trends expected in North America and Asia-Pacific by 2025.

One notable development is the adoption of machine learning algorithms for leak prediction and localization, pioneered by companies such as Emerson. These systems are designed to analyze historical sensor data, detect subtle patterns, and issue early warnings, reducing downtime and loss of valuable cryogenic media.

- Manufacturers are advised to prioritize open-architecture systems for seamless integration with facility management platforms and Industrial Internet of Things (IIoT) ecosystems.

- Investments in next-generation sensor materials—such as MEMS-based detectors and quantum cascade lasers—are likely to offer significant competitive advantage in terms of sensitivity and selectivity.

- Strategic partnerships with cryogenic equipment OEMs and end-users will accelerate product adoption, especially in the expanding LNG and hydrogen sectors.

- Compliance with evolving regional safety standards and environmental directives should be embedded in product development roadmaps.

In summary, the next few years will see cryogenic refrigerant leak detection systems become more intelligent, interconnected, and integral to both operational reliability and regulatory compliance, driven by innovation from leading industry players and tightening global standards.

Sources & References

- Honeywell

- Emerson Electric Co.

- Air Liquide

- MSA Safety Incorporated

- Gas Detectors USA

- Gas Alarm Systems

- SICK AG

- Siemens AG

- Honeywell International Inc.

- AMETEK

- Dräger

- Thermo Fisher Scientific

- European Commission

- International Organization for Standardization (ISO)

- Tanaka Engineering

- Danfoss

- MSA Safety Incorporated